Smartphone 3D Camera Market Overview

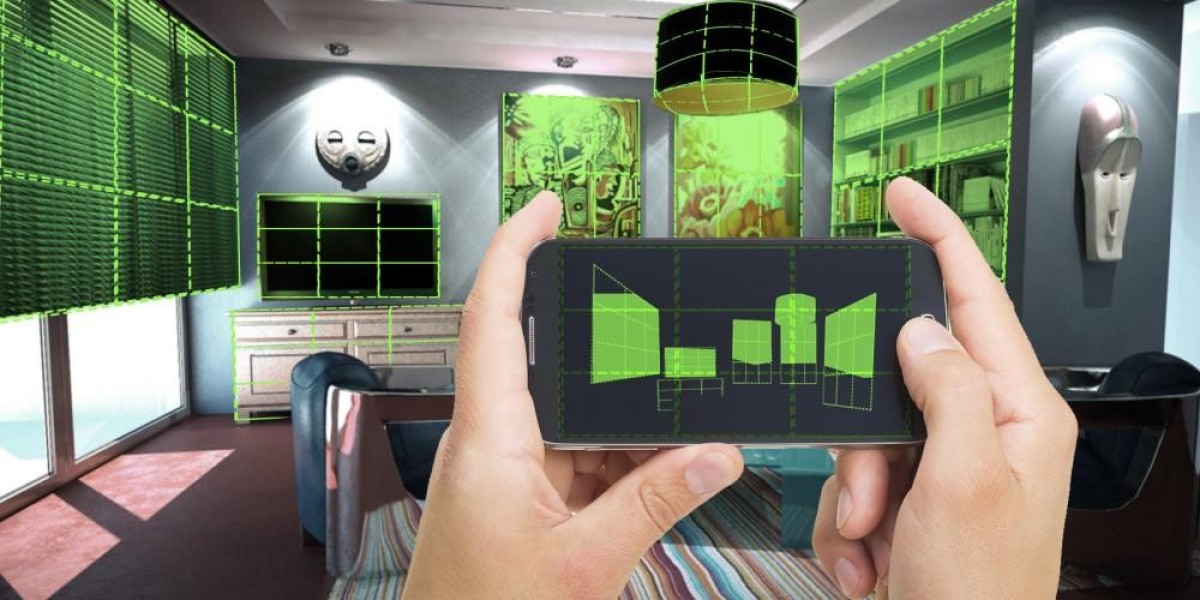

The smartphone 3D camera market has rapidly emerged as an essential segment within the broader mobile technology landscape. With technological advancements and increased consumer demand for more immersive mobile experiences, the integration of 3D cameras in smartphones has gained significant traction. Smartphone 3D cameras enable features like augmented reality (AR), face recognition, 3D modeling, and enhanced photo depth, revolutionizing how users capture and interact with images and video. Smartphone 3D Camera Market Size was estimated at 5.94 (USD Billion) in 2022. The Smartphone 3D Camera Market Industry is expected to grow from 6.52(USD Billion) in 2023 to 15.0 (USD Billion) by 2032.

A 3D camera captures three-dimensional data about objects and environments, which is instrumental in various applications such as facial recognition, biometric security, and AR experiences. With the expansion of online media sharing and the increasing popularity of applications that support AR, virtual reality (VR), and mixed reality (MR), demand for smartphone 3D cameras is expected to witness consistent growth.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/29654

Key Market Segments

The smartphone 3D camera market can be segmented by technology type, resolution, application, and region:

1. By Technology Type:

- Time-of-Flight (ToF): Widely used in premium smartphones for its precision in capturing depth information. ToF cameras emit infrared light to gauge distances and create 3D maps, making them ideal for AR applications and gesture control.

- Stereoscopic: Consisting of dual-lens setups, stereoscopic cameras mimic human vision by capturing two perspectives, allowing for precise depth sensing and 3D effect creation.

- Structured Light: This technology projects a light pattern onto objects to measure deformation and capture depth, providing a high level of accuracy in facial recognition.

2. By Resolution:

- Below 8 MP: Used in budget and mid-range smartphones where depth-sensing is limited to basic photography.

- 8 MP - 16 MP: Often found in mid-tier smartphones, providing reasonable depth and quality for general AR and facial recognition tasks.

- Above 16 MP: High-resolution 3D cameras are standard in premium smartphones, catering to users who require exceptional image depth and AR features.

3. By Application:

- Photography & Videography: Enhanced depth perception has revolutionized mobile photography, allowing users to capture high-quality 3D images and videos.

- Augmented Reality & Virtual Reality (AR & VR): AR applications rely heavily on 3D cameras for accurate tracking and interaction with virtual objects.

- Biometric Security: Facial recognition and other biometric systems have become more secure and accurate with the integration of 3D cameras.

- Gaming: AR-based gaming experiences are driven by accurate depth sensing, allowing users to engage interactively with virtual characters and environments.

Industry Latest News

The smartphone 3D camera industry has witnessed numerous developments, driven by innovation and strategic partnerships:

AR Capabilities Expansion: As mobile AR applications continue to grow, smartphone manufacturers are increasingly focused on improving AR experiences. Leading companies are refining ToF and structured light sensors to provide more immersive interactions and accurate 3D depth mapping for apps and games.

Collaboration with Tech Giants: Smartphone companies have partnered with tech giants specializing in AR and VR to enhance their 3D camera functionalities. For instance, Apple’s collaboration with AR software providers to optimize the LiDAR scanner on iPhones has set a benchmark for 3D camera integration.

Improvements in Depth Accuracy: The development of enhanced depth-sensing technologies, such as multi-point ToF and enhanced stereoscopic setups, has significantly increased accuracy, particularly in low-light conditions. These advancements improve the quality of both AR experiences and biometric recognition.

Software Innovations for 3D Imaging: Tech companies are introducing software updates that leverage AI and machine learning to improve depth-sensing accuracy. For example, Google’s ARCore and Apple’s ARKit frameworks continue to evolve, providing app developers with advanced tools to create more realistic AR experiences.

Key Companies

Several companies lead the way in smartphone 3D camera technology, continually innovating to offer enhanced user experiences and maintain market competitiveness. Here are some key players:

Sony Corporation: Sony’s Time-of-Flight sensors are widely adopted by leading smartphone brands for their accuracy and reliability. Sony’s sensors are key to enabling AR, VR, and biometric applications in high-end devices.

Apple Inc.: Known for its advanced camera systems, Apple integrates structured light and LiDAR technologies in its latest iPhone models. The iPhone’s 3D camera capabilities are particularly advanced in AR applications, making it a strong competitor in this space.

Samsung Electronics: Samsung has adopted both ToF and stereoscopic technologies, using them in flagship models to improve AR experiences and enhance image quality. Samsung’s advancements in 3D camera technology are pivotal to its AR applications, facial recognition, and VR integrations.

Huawei Technologies: Huawei’s innovations in ToF technology and high-resolution 3D cameras have set new standards in the smartphone 3D camera market. Huawei devices are popular in Asia and Europe for their high-quality imaging and AR capabilities.

LG Electronics: LG, though a smaller player, has been active in the development of 3D cameras for its smartphones, especially focusing on AR and VR. LG’s innovation efforts include collaboration with tech companies to improve ToF accuracy and battery efficiency.

Microsoft Corporation: Microsoft’s involvement in 3D camera technology, particularly through partnerships and contributions to AR technology, has influenced the smartphone industry, especially as the company expands into mobile VR and AR development.

Market Drivers

Several key factors drive the growth of the smartphone 3D camera market:

Growing Demand for Enhanced Photography and Videography: The shift in consumer preferences toward high-quality imaging and enhanced photography features has fueled the adoption of 3D cameras, allowing users to capture lifelike images with improved depth.

Increasing Popularity of Augmented Reality Applications: With advancements in AR and VR, demand for smartphones with 3D cameras has surged. This trend is evident in AR-based applications, including interactive learning, gaming, and social media, where users seek immersive experiences.

Rise in Facial Recognition for Security: Biometric security remains a major application for smartphone 3D cameras, especially as mobile devices become central to personal data security. 3D cameras enable secure facial recognition, which is widely adopted by banks and financial apps for secure login and transactions.

Growth in Social Media and Content Creation: The rise of social media has led to increasing demand for enhanced mobile cameras capable of creating immersive content. Platforms like Instagram and Snapchat use AR features that require 3D camera depth sensing, encouraging smartphone manufacturers to improve their camera technology.

Expansion of Mobile Gaming: Mobile gaming has seen significant growth, especially with AR-based games that require 3D camera capabilities. The success of games like Pokémon GO highlights the market potential for AR, encouraging smartphone manufacturers to develop devices with advanced 3D cameras.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/smartphone-3d-camera-market-29654

Regional Insights

The smartphone 3D camera market is experiencing growth globally, with specific regions leading in adoption and innovation.

1. North America

- Overview: North America is a significant player in the 3D camera market, driven by a high demand for AR and VR applications and widespread adoption of smartphones with advanced camera features.

- Growth Factors: High consumer spending on premium smartphones, a tech-savvy population, and a thriving app development ecosystem contribute to the region’s dominance in the smartphone 3D camera market.

2. Europe

- Overview: Europe has a mature smartphone market, with high consumer demand for enhanced imaging features and biometric security. The region’s robust data protection laws also encourage secure facial recognition technologies.

- Growth Factors: The popularity of social media, strong e-commerce growth, and interest in AR applications drive the demand for smartphone 3D cameras in Europe.

3. Asia-Pacific

- Overview: Asia-Pacific represents the fastest-growing market, driven by the high adoption rate of smartphones and the popularity of mobile gaming and AR applications.

- Growth Factors: Countries like China, Japan, and South Korea lead the market with strong smartphone manufacturing bases and a rising trend of AR integration in social media and gaming. The presence of tech giants such as Huawei and Samsung further boosts market growth.

4. Latin America and the Middle East & Africa

- Overview: These regions are emerging markets for smartphone 3D cameras, with increasing smartphone penetration and interest in mobile gaming and social media.

- Growth Factors: Growing disposable incomes, interest in mobile technology, and the adoption of biometric security for mobile devices are driving the market forward in these regions.

Conclusion

The smartphone 3D camera market is set for rapid growth, propelled by advancements in AR, VR, and biometric applications. As manufacturers focus on enhancing camera quality, depth sensing, and AI-driven features, demand is expected to remain strong. With significant contributions from leading companies and rising interest in immersive mobile experiences, the smartphone 3D camera market is positioned for continued expansion. The increasing popularity of AR-driven applications, mobile gaming, and security requirements will continue to drive innovation and adoption across global markets.