Roots Analysis has announced the addition of “Viral Vector, Non-Viral Vector and Gene Therapy Manufacturing Market (5th Edition), 2022-2035” report to its list of offerings.

Over the past few years, cell and gene therapies have gained significant popularity owing to their therapeutic potential. In fact, more than 20 genetically modified therapies have already been approved, which has resulted in the increase in demand for vectors, which have proven to be highly efficient for the delivery of genetic material to the targeted area. In order to cater to the growing demand, several companies are offering diverse range of services for vector and gene therapy manufacturing. The viral vector manufacturing and non-viral vector manufacturing landscape features a mix of industry players (well-established companies, mid-sized firms and start-ups / small companies), as well as several academic institutes.

Key Market Insights

More than 140 stakeholders claim to manufacture viral and non-viral vectors

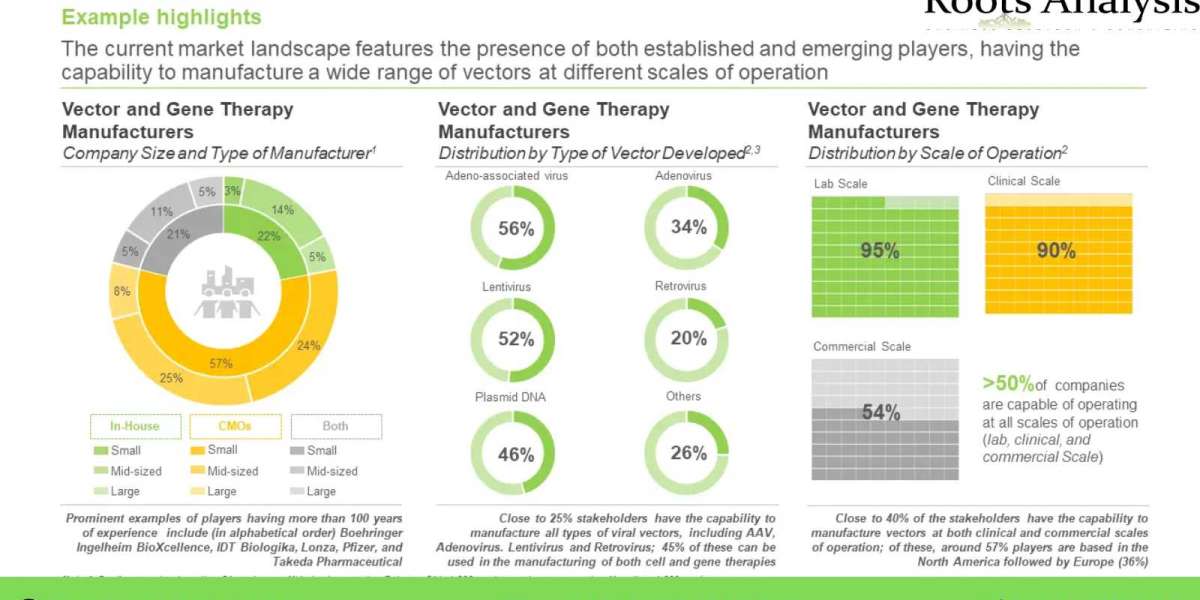

The market is currently dominated by the presence of various mid-sized industry players (50%); of these 57% of players are contract manufacturers, whereas 22% of players are in-house manufacturers.

Over the time, several advancements have been made for the development of vector based technological platforms

Majority (37%) of the available technologies are currently used in vector manufacturing followed by those available for manufacturing of cell and gene therapies (16%). Further, 53% of the vector-based technologies are dedicated for the development and manufacturing of adenoviral vectors.

More than 295 partnerships were established between different stakeholders during the last decade

Close to 55% partnerships have been reported post 2018, wherein, maximum partnerships were recorded in year 2022 (till May). Further, maximum partnerships were related to manufacturing (23%) followed by licensing agreement (20%) and product development agreement (15%).

Close to 120 expansion activities have been recorded till 2022, growing at a CAGR of 10%

Majority of the expansions in this domain were related to the establishment of new facility (39%) followed by facility expansion (12%).

The installed vector manufacturing capacity is estimated to be ~186,150 L

Majority (70%) of total installed capacity is currently available for clinical / commercial stage manufacturing of viral vectors. Further, players headquartered in North America (56%) have the highest installed capacity, across the globe.

Till 2035, the annual demand for vectors is expected to grow at an annualized rate of 11%

Currently, North America and Europe contribute to more than 70% of the demand for viral and non-viral vectors. By 2035, the demand, in terms of number of patients in clinical and commercial stage, demand for vectors, is projected to be ~ 400 thousand patients.

The market is anticipated to grow at a significant rate, during the period 2022-2035

The majority share of service revenues is anticipated to come from vector manufacturing projects focused on oncological disorders (51%). By 2035, Europe is likely to capture the major share (42%) of the market followed by North America (30%) and Asia-Pacific (23%).

To request a sample copy / brochure of this report, please visit link

https://www.rootsanalysis.com/reports/274/request-sample.html

Key Questions Answered

- Who are the leading players (contract service providers and in-house manufacturers) engaged in the development of vectors and gene therapies?

- Which regions are the current manufacturing hubs for vectors and gene therapies?

- Which type of technologies are presently offered / being developed by the stakeholders engaged in this domain?

- Which companies are likely to partner with viral and non-viral vector contract manufacturing service providers?

- Which partnership models are commonly adopted by stakeholders engaged in this industry?

- What type of expansion initiatives are being undertaken by players in this domain?

- Which are the emerging viral and non-viral vectors used by players for the manufacturing of genetically modified therapies?

- What are the opportunities and threats for the stakeholders engaged in this industry?

- What is the current, global demand for viral and non-viral vector, and gene therapies?

- How is the current and future market opportunity likely to be distributed across key market segments?

By 2035, the financial opportunity within the viral vector, non-viral vector and gene therapy manufacturing market has been analyzed across the following segments:

- Scale of Operation

- Lab

- Clinical

- Commercial

- Type of Vectors

- AAV

- Adenoviral

- Lentiviral

- Retroviral

- Plasmid DNA

- Other Vectors

- Application Area

- Gene Therapy

- Cell Therapy

- Vaccines

- Therapeutic Area

- Oncological Disorders

- Rare Disorders

- Neurological Disorders

- Sensory Disorders

- Metabolic Disorders

- Musco-skeletal Disorders

- Blood Disorders

- Immunological Diseases

- Others

- Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- MENA

- Rest of the World

The report also features inputs from eminent industry stakeholders, according to whom, the anticipated increase in demand for cell and gene therapies, is the most prominent driver of the growth of the vector supply market. The report includes detailed transcripts of discussion held with prominent industry representatives:

- Menzo Havenga (Chief Executive Officer and President, Batavia Biosciences)

- Nicole Faust (Chief Executive Officer Chief Scientific Officer, CEVEC Pharmaceuticals)

- Jeffrey Hung (Former Chief Commercial Officer, Vigene Biosciences)

- Cedric Szpirer (Former Executive Scientific Director, Delphi Genetics)

- Olivier Boisteau, (Co-Founder / President, Clean Cells), Laurent Ciavatti (Former Business Development Manager, Clean Cells) and Xavier Leclerc (Head of Gene Therapy, Clean Cells)

- Alain Lamproye (Former President of Biopharma Business Unit, Novasep)

- Joost van den Berg (Former Director, Amsterdam BioTherapeutics Unit)

- Bakhos A Tannous (Director, MGH Viral Vector Development Facility, Massachusetts General Hospital)

- Eduard Ayuso, DVM, PhD (Scientific Director, Translational Vector Core, University of Nantes)

- Colin Lee Novick (Managing Director, CJ Partners)

- Semyon Rubinchik (Scientific Director, ACGT)

- Astrid Brammer (Senior Manager Business Development, Richter-Helm)

- Marco Schmeer (Project Manager, Plasmid Factory) and Tatjana Buchholz (Former Marketing Manager, Plasmid Factory)

- Brain M Dattilo (Business Development Manager, Waisman Biomanufacturing)

- Beatrice Araud (ATMP Key Account Manager, EFS-West Biotherapy)

- Nicolas Grandchamp (RD Leader, GEG Tech)

- Géraldine Guérin-Peyrou (Director of Marketing and Technical Support, Polypus Transfection)

- Naiara Tejados, Head of Marketing and Technology Development, VIVEBiotech)

- Jeffery Hung (Independent Consultant)

The research includes profiles of key players (listed below), featuring a brief overview of the company, its financial performance (if available), information related to its manufacturing facilities, proprietary vector manufacturing technology and an informed future outlook.:

- Advanced BioScience Laboratories

- Aldevron

- Audentes Therapeutics

- BioNTech Innovative Manufacturing

- BioReliance

- Biovian

- bluebird bio

- Cell and Gene Therapy Catapult

- Celonic

- Centre for Process Innovation

- Cobra Biologics

- Emergent BioSolutions

- FinVector

- FUJIFILM Diosynth Biotechnologies

- Kaneka Eurogentec

- Lonza

- MeiraGTx

- MolMed

- Novasep

- Orchard Therapeutics

- Oxford BioMedica

- Richter-Helm

- Sanofi

- Spark Therapeutics

- Thermo Fisher Scientific

- uniQure

- Vibalogics

- Vigene Biosciences

- VIVEbiotech

- Wuxi AppTech

For additional details, please visit link https://www.rootsanalysis.com/reports/view_document/viral-vectors-non-viral-vectors-and-gene-therapy-manufacturing-market-/274.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- 3D Cell Culture Market (4th Edition): Industry Trends and Global Forecast, 2022-2035

- Gene Therapy Market: Industry Trends and Global Forecast, 2022-2035

About Roots Analysis

Roots Analysis is one of the fastest growing market research companies, sharing fresh and independent perspectives in the bio-pharmaceutical industry. The in-depth research, analysis and insights are driven by an experienced leadership team which has gained many years of significant experience in this sector.

Contact:

Ben Johnson

+1 (415) 800 3415